In today’s Bitcoin price roundup:

- Bitcoin rallies but faces resistances at $22,000.

- The difference between the 2018 bear market and 2022.

- Merge hopes push the Ethereum price to $1.5K, resulting in double digit gains.

- The battle between the bulls and bears continues.

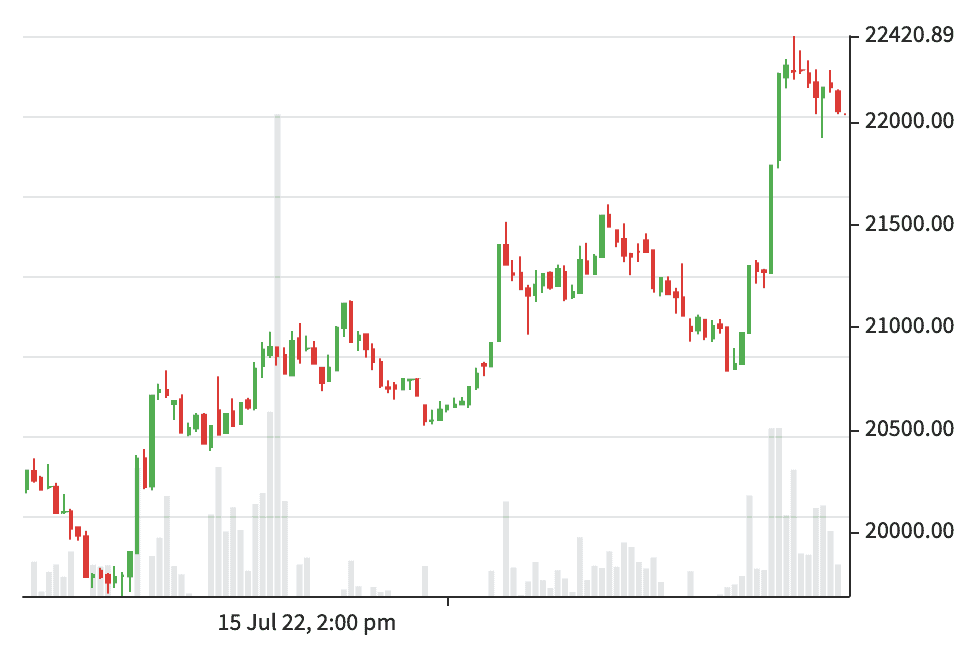

Bitcoin Faces Resistance At $22,000

On Sunday, Bitcoin fell below $21,000 ending its four day streak and falling by 1.7%, with its current price still higher than it was before it began its four day winning streak.

Market observers expect the crypto giant to continue trading between the $18,000 to $22,000 range that it has maintained for a month, at least until investors have a clearer sign whether central banks can keep the ever rising inflation rate in check without plunging the global economy into a recession.

“While Bitcoin saw positive momentum this week, it remains range-bound when you take a broader view, and is still struggling to cross the $22,000 resistance”. This is what Joe DiPasquale, the CEO of crypto asset manager BitBull Capital, said to CoinDesk. DiPasquale added that “BTC managed to stay strong,” despite inflation being at a 40-year high and the Federal Reserve seemingly being unable to do anything about it. “For now, we remain interested in the bottom of this range when it comes to Bitcoin’s price, and are monitoring for accumulation during this range-bound movement”, DiPasquale mentioned.

The Difference Between the 2018 and 2022 Bear Markets

In a recent article on CoinDesk, 2018, when the ICO hype peaked, markets crashed which led to the crypto winter of 2018-2019. Numerous retail investors got burned due to the rapidly dropping prices while those who could afford to HODL through the dark days came out at the top, beating both the stock market and high growth tech stocks.

After the ICO crash, measures were put in place to prevent a recurrence of the 2018 sell-off, such as the introduction of automated market makers (AMMs). AMMs would slow down the price slippage that occurred when a seller could not find a buyer on a centralized marketplace . AMMs provide liquidity by acting as a counterparty.

It’s also important to keep in mind that this bear market is driven by a general sell-off across all assets. The current macro landscape and hawkishness of the Federal Reserve is a large driver of the current Bitcoin bear market.

In an attempt to manage inflation, The Federal Open Market Committee, which sets monetary policy, meets next Tuesday and Wednesday and is widely expected to raise interest rates by at least 75 basis points.

This will put more pressure on risk-assets, including Bitcoin.

‘Merge Trade’: A Catalyst for Ethereum’s Price?

Crypto Markets were suddenly looking bullish today, including Bitcoin which had its best day of the year, with only ethereum posting even bigger gains. Ethereum 2.0 seems to have spiked renewed investor interest with the price increasing by a whopping 22%, hitting a one-month high of $1,475, according to CoinDesk data. The token registered a 15% gain in the seven days leading up to July 17th, the biggest jump since March. Ether’s bounce is accompanied by renewed demand for the blockchain, a sign that the rally may have legs. However, while there might be more upside in the short term, it probably depends on the upcoming Ethereum merge which is planned to happen in September, as developers have hinted. A potential delay could demoralize buyers. Also seeing a sharp increase is Matic’s price which has jumped nearly 44% in the last 7 days.

In the early hours of this morning, Ethereum traded at over $1,500 setting a one month high, breaking out of its $1,000 – $1,200 range. Even though resistance around $1,350 exists, the price chart suggests that prices could continue rallying and hit $1,800.

“ETH has undergone a rapid change in narrative over the past week with speculators purely focused on the upcoming ‘merge’ as a catalyst for appreciation,” said Matthew Dibb, COO and co-founder of Stack Funds. “Adding to this, we believe that there is a significant amount of sidelined capital that has been waiting on bullish momentum to establish new positions.”

The Ethereum 2.0 upgrade has been long overdue and has seen several delays. However, the recent successful mergers of the Ropsten and Sepolia testnets and the Goerli testnet’s planned transition to proof-of-stake on the 11th of August has raised hopes for the mainnet merge in September.

The Battle between the Bulls and Bears

With the upcoming merger, interest in ethereum has peaked and analysts expect the price to keep going up. With the opinion that ethereum is rising in anticipation for Ethereum 2.0, as long as there is no delay in the timeline for the proposed merger.